Asset allocation calculator by age

Asset allocation involves dividing an investment portfolio among different asset categories such as stocks bonds and cash. If you were born between 1943 and 1954 for example your FRA is 66.

Asset Allocation Spreadsheet Excel Template White Coat Investor

Allocating assets among underlying Fidelity funds according to a neutral asset allocation strategy that adjusts over time until it reaches an allocation similar to that of the Freedom Index Income Fund approximately 10 to 19 years after the target year.

. For an annual management fee and a minimum investment of 100000. That will do a one-time evaluation of your portfolio and make recommendations to improve your asset allocation. The Pralana Gold calculator is a robust personal financial model that contains hundreds of fully-integrated calculators and deals with every phase of your life.

Age 59 Under Age 59 12 Above. Selecting an asset allocation in your 401k is one of the first steps of retirement planning. The full retirement age in the US.

Estimated Income Gap dollar amount. Asset allocation strategies we might recommend. College Savings Calculator 529 Savings Plan Overview 529 State Tax Calculator Learning Quest 529 Plan Education Savings Account.

All the investors has to do is provide some few inputs and the mutual fund SIP calculator throws the result instantly. A Rules-Based Index is an index where the weightings of the components are determined following a preset algorithmic set of rules and proprietary formulas. Age 59 Under Age 59 12 Above Required Minimum Distributions.

However some other experts say you should aim to have half of your annual salary saved by that age. One needs to follow the below steps in order to calculate the Asset Allocation. By the time youre 40 you should have triple your annual salary.

You can initiate these transactions no matter your age and the amount will not count towards your annual contribution limit. 38 billion-fund manager says asset allocation that hurt stocks is reversing now. Therefore a prudent investor should consider understanding the taxation of individual multi-asset funds with the help of detailed analysis of the scheme information documents SID available on the fund houses website.

The fund managers role is one of importance when it comes to multi-asset allocation funds. The asset allocation that works best for you at any given point in your life will depend largely on. Everything we do asset allocation trailing stops position-sizing and stock selection is done with an eye to not only maximize returns but also limit risk.

Retirement Expense Income Calculator. For those born in or after 1960 is 67. Ultimately the fund will merge with the Freedom Index Income Fund.

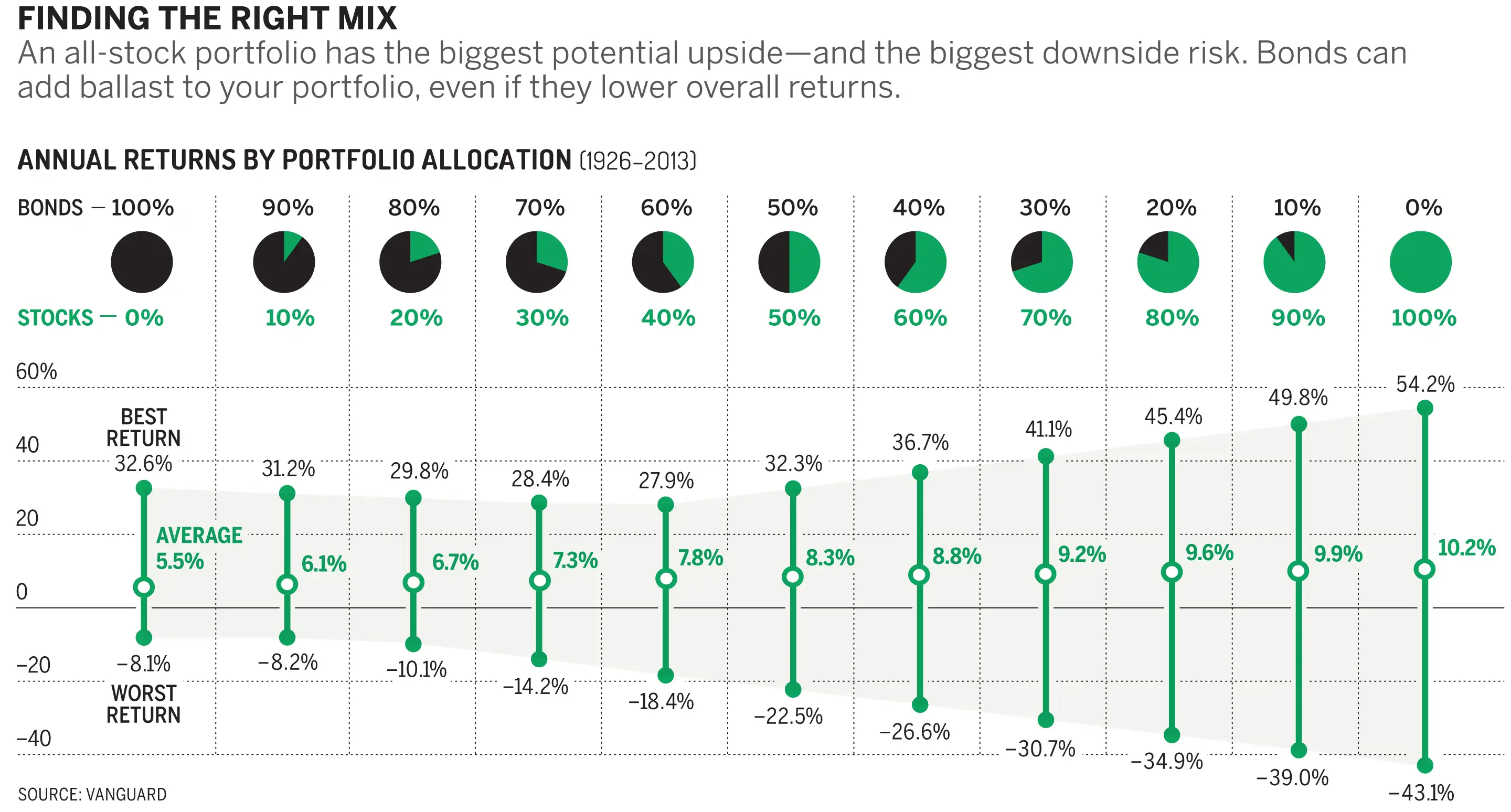

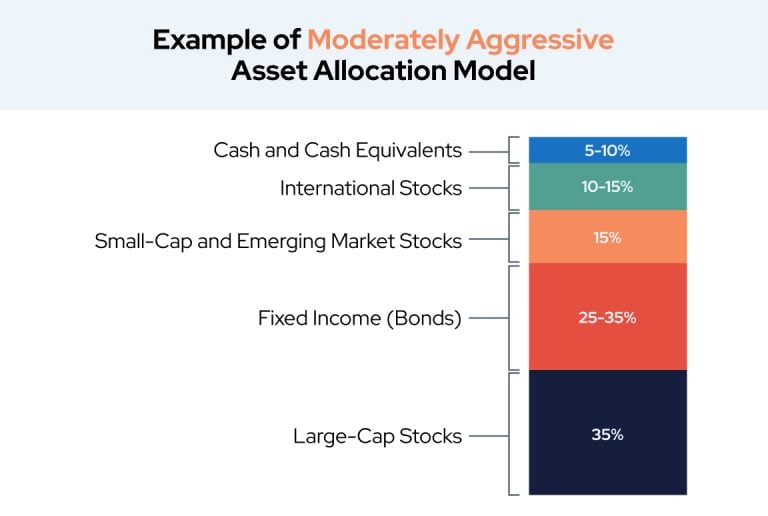

Studies show we are living longer due to advancements in science and better awareness about how we should eat. Conservative Income Income with Growth Balanced Balanced with Growth. The New Life asset allocation recommendation is to subtract your age by 120 to figure out how much of your portfolio should be allocated towards stocks.

Out of the 4 asset classes ie equity corporate bonds government bonds alternative assets the allocation to equities cannot be more than 75 of the corpus and that too is valid only up to 50 years of age. Step 2 Age is the most important factor here which should be. Moderate allocation of 50 Stocks 45.

The process of determining which mix of assets to hold in your portfolio is a very personal one. Risk Profile asset allocation choose one Conservative allocation of 25 Stocks 60 Bonds and 15 Cash. For example if youre 30 you should keep.

College Savings Calculator 529 Savings Plan Overview 529 State Tax Calculator Learning Quest 529 Plan Education Savings Account. From 51 years onwards the allocation to equity starts tapering off as per a defined matrix. A Futures contract is an agreement to make and receive a cash payment based on changes in the price of a particular commodity or financial instrument at a pre-determined date in the future.

Step 1 Determine the individuals risk profile the investments goal and the number of years for which the investment is to be made. The calculator will also provide your FIRE age. If you prefer complete investment management you can use the Personal Capital Wealth Management service.

Its fine if an individual stock grows to become a significant percentage of your total portfolio provided you are running a trailing stop behind it to protect your profits. However you still need to take RMDs at age 72 or 705 depending on your birthday. The old rule of thumb used to be that you should subtract your age from 100 - and thats the percentage of your portfolio that you should keep in stocks.

Your lifes earnings determine this amount. Let us now see how to calculate SIP returns using the SIP calculator online. Asset Allocation Mutual Funds Target Date Mutual Funds Commodity Mutual Funds.

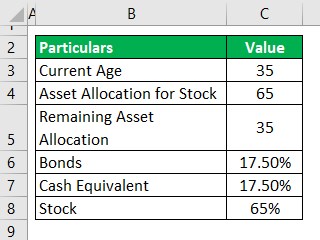

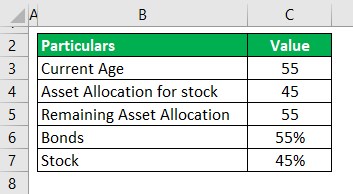

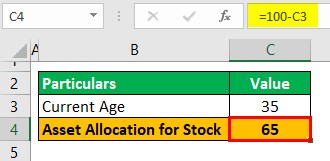

With the ability to change the allocation over time New for 2022. Asset allocation can be done at an overall level. How to Calculate Using Asset Allocation Calculator.

If you go by Fidelitys benchmark and you earn 40000 a year aim to have about that amount socked away for retirement by age 30. By age 50 you should have six times. Generally a SIP return calculator has 3 input boxes - Monthly investment amount investment period and the expected returns.

Full retirement age is the age at which you have access to your full Social Security benefits. You can subtract your age from 110 or 100 to find the percentage of your portfolio that should be. Standard Deviation Calculator Income Tax Calculator Age Calculator Time Calculator BMI Calculator GPA Calculator Statistics Calculator Fraction Calculator Diabetes Risk Calculator Date Calculator Log Calculator.

Optimized withdrawal order Social Security start age and. Keep in mind that contribution and age limits do not apply to rollovers conversions or transfers between retirement accounts.

Types Of Investment Asset Allocation Calculators Help Learning How To Invest Money

Asset Allocation The Ultimate Guide For 2021

Types Of Investment Asset Allocation Calculators Help Learning How To Invest Money

The Proper Asset Allocation Of Stocks And Bonds By Age

Asset Allocation Calculator Allocate The Assets Using Thumb Rule

Proper Asset Allocation Of Stocks And Bonds By Age New Life Financial Samurai Stocks And Bonds How To Get Money Bond

The Proper Asset Allocation Of Stocks And Bonds By Age

Types Of Investment Asset Allocation Calculators Help Learning How To Invest Money

This Is The Right Amount Of Stocks To Own At Every Age Money

I Am 30 Years Old What Should My Ideal Asset Allocation Be Investeek

Asset Allocation The Ultimate Guide For 2021

Asset Allocation Calculator Allocate The Assets Using Thumb Rule

The Proper Asset Allocation Of Stocks And Bonds By Age

Asset Allocation Calculator Allocate The Assets Using Thumb Rule

Fire Calculator When Can I Retire Early Engaging Data

Types Of Investment Asset Allocation Calculators Help Learning How To Invest Money

What Is Asset Allocation How Is It Important In Investing